Speculate or Earn Premiums from NFT Options

NFTCall is a physically-settled, peer-to-peer NFT options trading platform that allows NFT holders to earn premiums and sell NFTs at a higher price while allowing NFT investors to buy NFTs with high leverage but with limited losses.

Sell, buy and exercise options in just one step

NFTCall creates a derivative market where both NFT holders and investors can benefit from our physically-settled options, peer-to-peer model, flexible options exercise mechanism, and cost-effective fee structure.

Physical Settlement

NFTCall creates a new NFT trading experience with physically-settled options.

Peer-to-peer model

We use a peer-to-peer model to ensure both NFT holders and investors can benefit from options contracts.

Flexible options exercise

NFTCall combines features of American and European style options. Buyers can exercise the options during the second half of the period before the expiration.

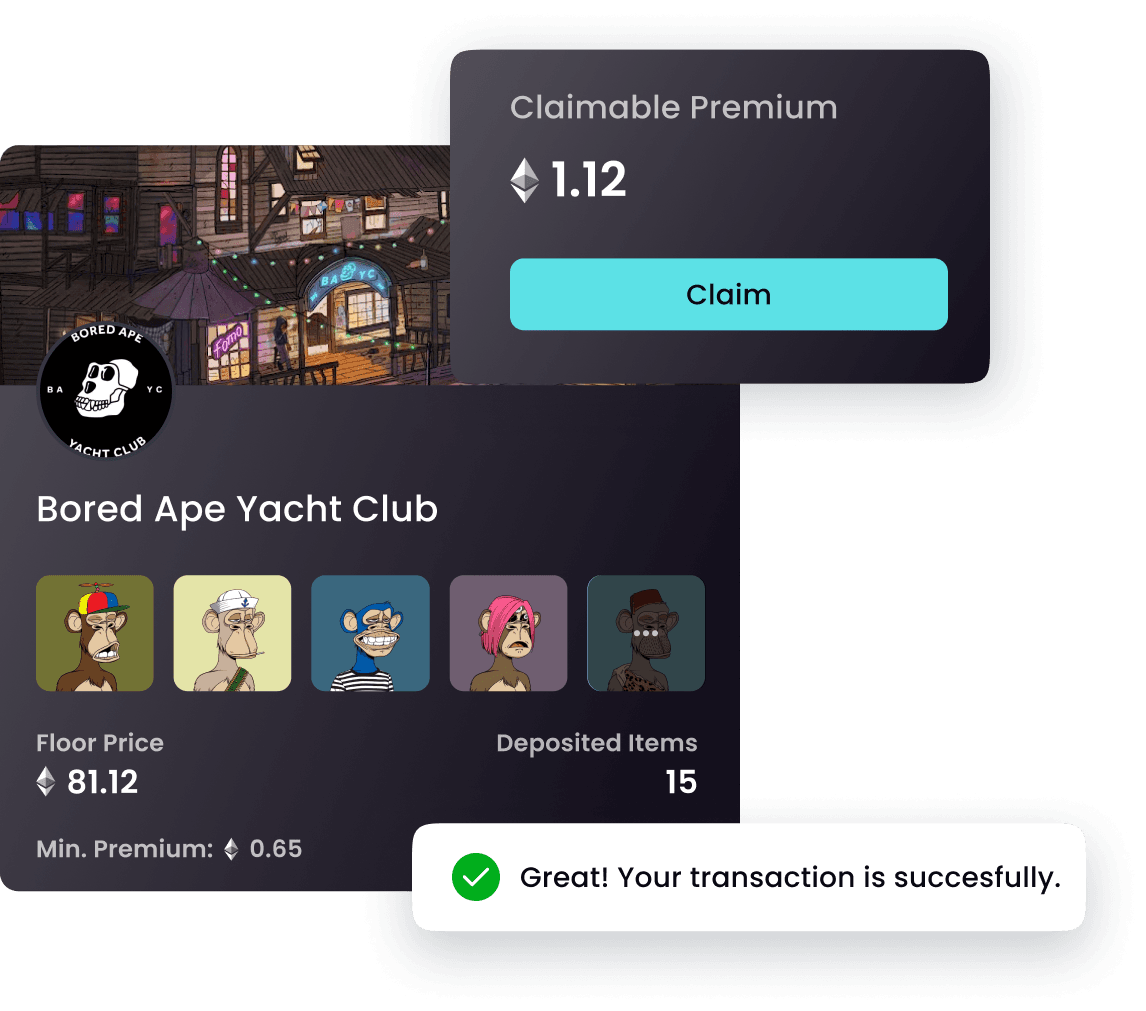

For NFT Holders

Sell NFT at a higher price while earning premiums

NFT holders deposit their NFTs into the market for call options selling, which means they promise to sell their NFTs at a specified price in the future. And the specified price is usually higher than the current floor price. If the market price rises above the specified price on the expiration date, their NFTs will be sold to the options buyers, otherwise, they can receive passive income from the sold options.

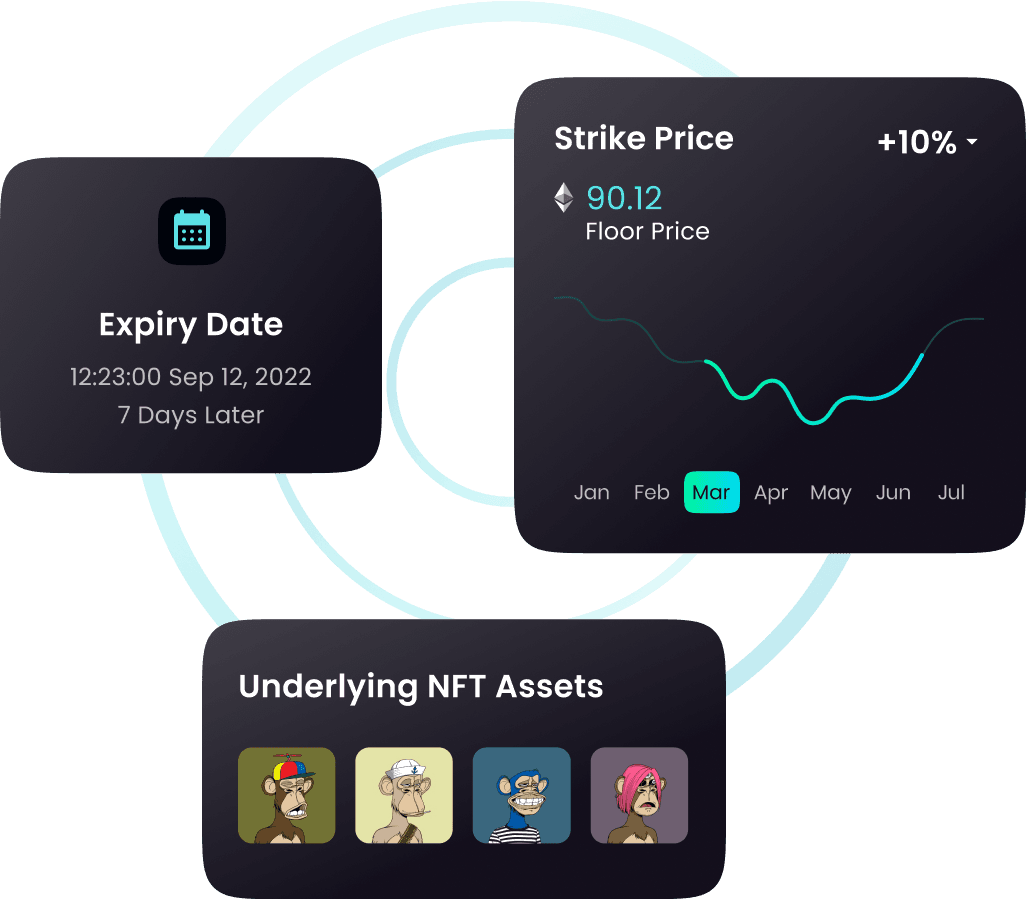

For NFT Investors

Buy NFTs with high leverage but limited losses

NFT investors can pay a small premium in advance for the call options, which means they lock in a price at which to buy the NFT in the future. If the floor price rises above the specified price on the expiration date, options buyers can take the NFT and sell it on the market for a profit, otherwise they only lose the small premium.

Roadmap

2023 Q1

Mainnet Launch

Complete the code audit and launch the NFTCall protocol on the Ethereum mainnet.

2023 Q2

Cash-settled NFT Options

Launch the NFTCall protocol on the Layer-2 Arbitrum with a liquidty pool for cash-settled NFT options.

2023 Q3 & Q4

NFT Perpetuals

Develop our NFT perpetual trading platform based on the peer-to-pool model, providing more liquidity and flexibility for NFT speculation and hedging purpose.

Start Trading Now!

Speculate, hedge and earn income from NFT options.